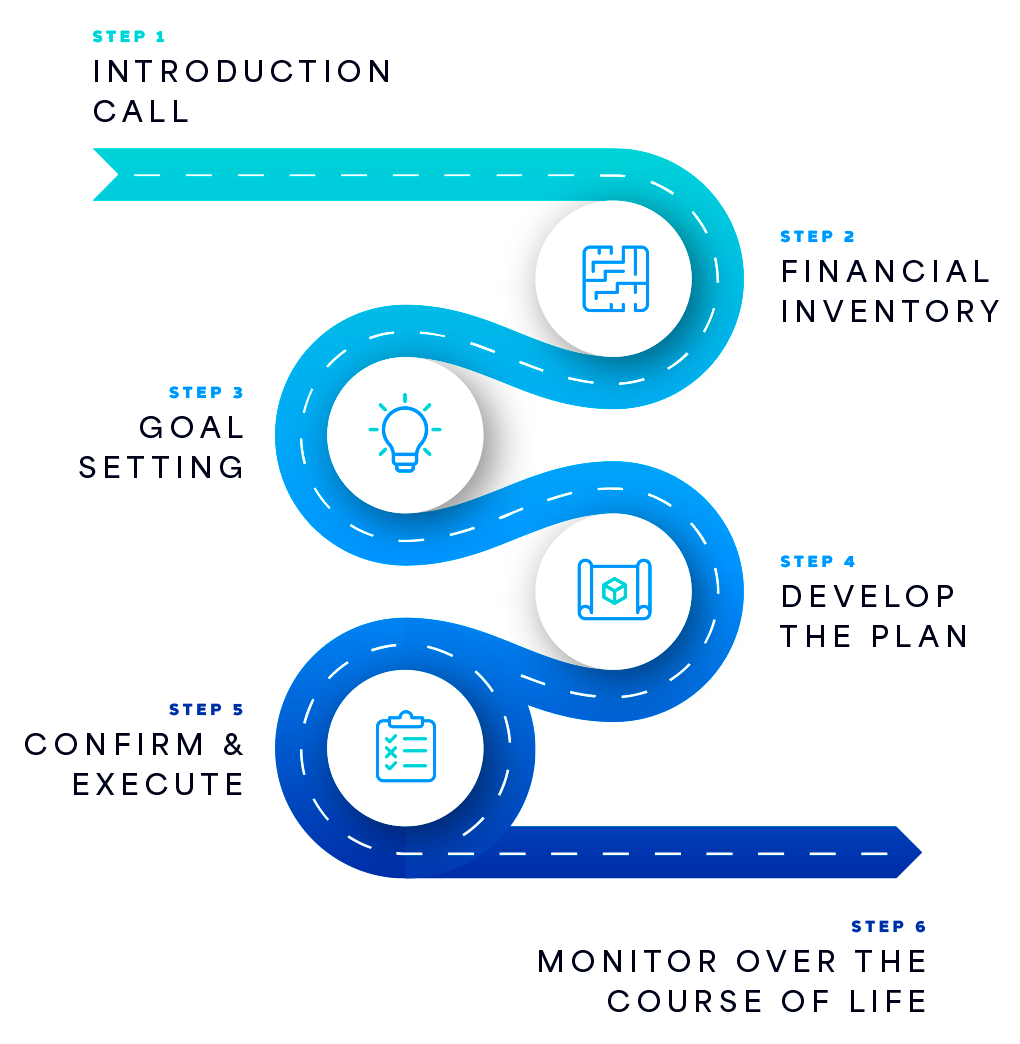

We Follow A Comprehensive Wealth Planning Process.

We believe that wealth isn’t just about increasing numbers; it’s about enriching the lives of those you love.

As good stewards and partners with our clients, we follow a comprehensive wealth planning process that centers entirely around you and your personal money story and wealth goals.

— OUR CLIENTS CAN EXPECT —

Our Process For Working Together.

1. Introduction Call

We start with an Introduction call where we learn about you and you learn about us. We know that trust is a matter of confidence in our approach and personality fit, so this call gives us the chance to evaluate if we want to work together.

2. Financial Inventory

The first step in forging a path forward is to take stock of where you are today. We’ll collect documents such as bank statements, tax returns, investment statements, and 401k statements. These documents plus our intake questionnaire allow us to do the analysis to understand your baseline financial picture.

3. Goal Setting & Planning

We review the current state financial picture and then dream about the future. At the end of this meeting, and with our guidance and education, you’ll have defined your goals and then we work on the plan that will empower your family to achieve its ambitions.

4. Develop the Plan

We do the math on your goals and develop the financial strategies that align to your preferences and needs.

5. Confirm and Execute

We review the financial plan, cash flow strategies, and investment strategies. Upon agreement, we’ll move to the “doing.” We will choose and manage the day-to-day investing for your hard-earned money, matching you to portfolios based on your personal risk assessment and the intended use of the funds. We help balance risk and return and utilize tax-efficient investment strategies tailored to your long-term goals.

6. Monitor Over the Course of Life

You can expect proactive contacts throughout the year to review insurance, tax and investment performance. We also hold annual or quarterly meetings to comprehensively review your financial plan, how your money is performing, and to reset or recalibrate as needed. And, if anything happens in your life between our appointments, you can call our team. We’re here for the scheduled life events and the unscheduled ones.

Cash Flow Planning

The Heartbeat of Your Financial Goals

One of the things that sets our practice apart is our focus on cash flow planning. Money in and money out is the heartbeat of a well-conceived financial plan. Many of our clients tell us that they didn’t really know what they were spending on a day-to-day basis until they worked with us, and that the knowledge they gained helped them be more intentional with their hard-earned money. We’ll work with you to map the flow of your money, so you can align your finances to your values and your goals.

An Introduction Call is a no-pressure conversation that lets us learn about each other. We’ll take time to share how we work with our clients and what our process looks like, and you’ll have a chance to ask us any questions you may have.

To get started, complete the contact form below. A member of our team will reach out to get the call scheduled.

Ready to explore working together?

Take a Look

Check the background of your financial professional on FINRA's BrokerCheck.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

Securities and Advisory Services offered through LPL Financial, a Registered Investment Advisor. Member FINRA & SIPC.

The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the following states: MS and LA.

Disclosure